Business Insurance in and around Alamo

Alamo! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

This Coverage Is Worth It.

You've put a lot of resources into your small business. At State Farm, we recognize your efforts and want to help insure you and your business, whether it's a photography business, a confectionary, a pharmacy, or other.

Alamo! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

You are dedicated to your small business like State Farm is dedicated to great insurance. That's why it only makes sense to check out their coverage offerings for builders risk insurance, commercial auto or worker’s compensation.

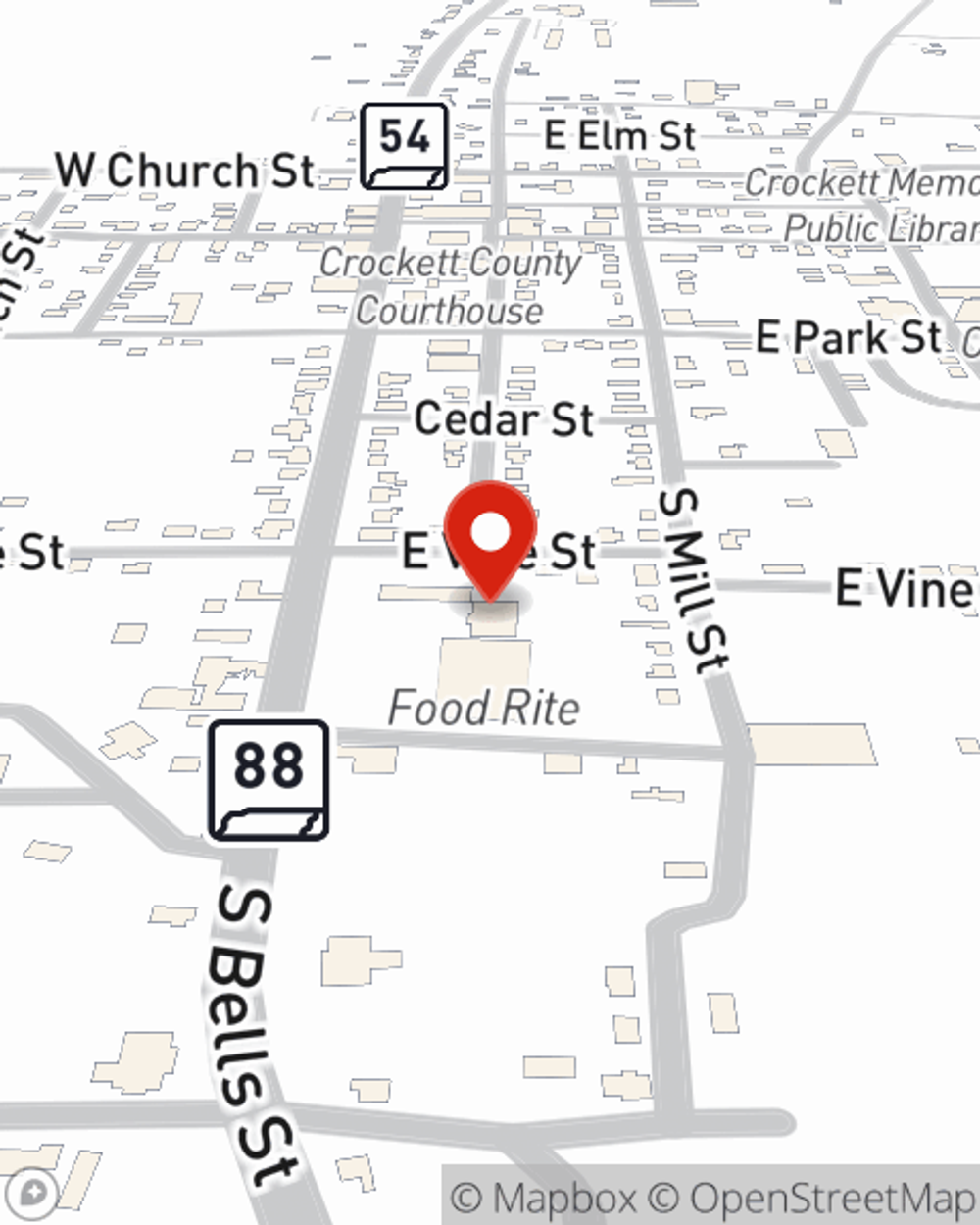

Since 1935, State Farm has helped small businesses manage risk. Visit agent Joe Gomez's team to review the options specifically available to you!

Simple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.

Joe Gomez

State Farm® Insurance AgentSimple Insights®

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Top reasons to add an accessory dwelling unit to your home

Top reasons to add an accessory dwelling unit to your home

Look at the rising trend of accessory dwelling units and check out tips to help you decide if one of these small homes is right for your big plans.